REGELBASIERTE

VERMÖGENSVERWALTUNG

Klar definierte Regeln für alle Marktlagen

Unser Ansatz

Wir verbinden moderne Informationstechnologie mit persönlicher Beratung und unterstützen sowohl Private Investoren als auch institutionelle Partner bei der Verwirklichung ihrer Anlageziele.

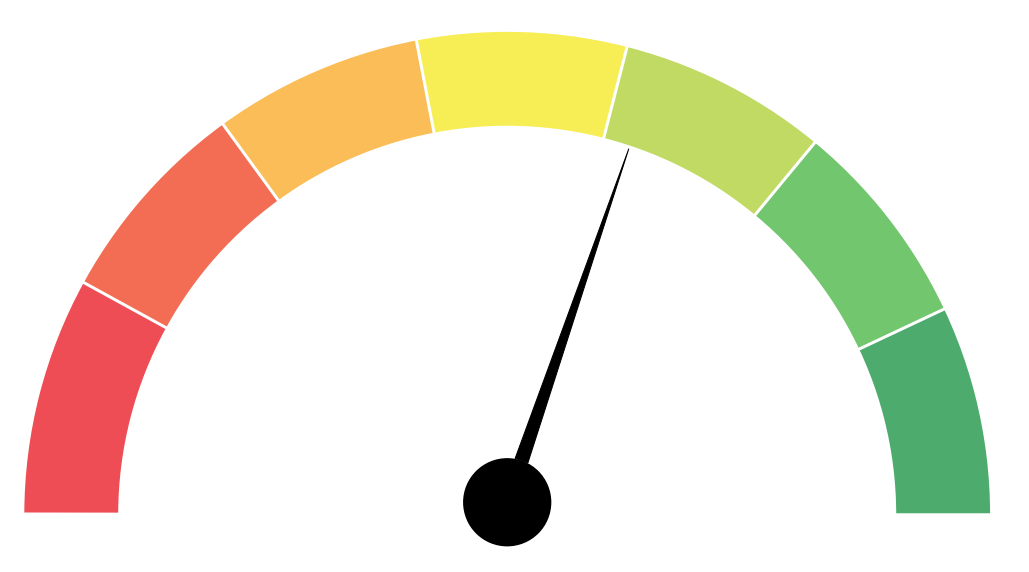

Regelbasierter Marktradar

Unser regelbasierter Marktradar wertet täglich Daten aus und bewertet die aktuelle Marktsituation. Dies ermöglicht es uns, auch in turbulenten Zeiten gelassen zu bleiben.

Vermeidung grosser Verluste

Unsere Portfolios passen sich dynamisch dem Marktumfeld an und reduzieren automatisch das Verlustrisiko in Krisen. So können wir Portfolios zielsicher auch durch schwierige Marktphasen manövrieren.

Einfach investieren

Die Anlagelösungen von Dufour Capital können in nur wenigen Schritten entweder als Zertifikate oder über Mandate investiert werden.

Referenzen

Neben Privatkunden vertrauen auch verschiedene renomierte institutionelle Partner wie zum Beispiel das VZ VermögensZentrum oder die Basler Kantonalbank auf unsere Expertise.

Die Grundlagen und verschiedene Anwendungsbeispiele der regelbasierten Geldanlage haben wir einfach und verständlich in verschiedenen Fachbüchern publiziert (Orell Füssli / Amazon / Wiley / BlackRock Smart Beta Guide).

Dufour Capital verfügt über eine Zulassung der FINMA als Vermögensverwalter.

|

|

|

Was bedeutet regelbasiert?

Regelbasiertes Investieren bezieht sich auf Anlagestrategien, die vordefinierte und bewährte Regeln anstelle von individuellen Entscheidungen verwenden. Diese Strategien stützen sich auf historische Daten und objektive Entscheidungskriterien. Beispiele hierfür sind das antizyklische Rebalancing oder die Nutzung von Markttrends für Anlageentscheidungen.

In der Vermögensverwaltung steht regelbasiert für automatisierte, kosteneffiziente Prozesse und eine konsistente sowie transparente Umsetzung von Anlageentscheidungen. Auf diese Weise lassen sich menschliche Emotionen wie Angst oder Gier vermeiden, die häufig zu Fehlentscheidungen führen können.

Welche Vorteile bietet die regelbasierte Vermögensverwaltung?

Die regelbasierte Vermögensverwaltung basiert auf systematischen Anlagestrategien, die auf objektiven Daten und Kriterien beruhen. Dies führt dazu, dass emotionale Entscheidungen oder unsichere Prognosen vermieden werden, da klare Regeln zum Einsatz kommen. Die Portfolios passen sich dynamisch und adaptiv an das Marktumfeld an. Zudem wird ein effektives Risikomanagement angewandt, um Verluste zu begrenzen. Die Umsetzung erfolgt mit kosteneffizienten Portfolios, die auf ETFs oder Aktien basieren.

Wodurch zeichnet sich Dufour Capital als Vermögensverwalter aus?

Dufour Capital ist ein erfahrener Pionier der regelbasierten Vermögensverwaltung in der Schweiz. Als unabhängiges Partnerunternehmen des VZ VermögensZentrums beraten wir namhafte institutionelle Kunden, darunter Kantonalbanken, bei der regelbasierten Geldanlage. Unsere Gründung vor 12 Jahren basierte auf unserer langjährigen Forschungs -und Finanzerfahrung, die es uns ermöglichte, moderne Informationstechnologie in der Vermögensverwaltung einzusetzen.

Wir handeln unabhängig und ohne Interessenkonflikte und investieren gemeinsam mit unseren Kunden in die gleichen Anlagen. Persönlicher Service steht bei uns an erster Stelle, und wir sind jederzeit für unsere Kunden erreichbar, um ihre Fragen zu beantworten. Über unser Netzwerk bieten wir auch Beratung zu Immobilien, Steuern, Nachlassplanung und Ruhestandsplanung an.